Irs 1099 Filing Deadline 2024 Due Time

-

admin

- 0

Irs 1099 Filing Deadline 2024 Due Time – Tax Season 2024 is underway. You should be receiving your important tax documents from employers, mortgage companies and more over the past and coming weeks, so you can file with all the necessary . The 2024 tax season has commenced, with the IRS now accepting tax returns until Tax Day, which is on April 15. .

Irs 1099 Filing Deadline 2024 Due Time

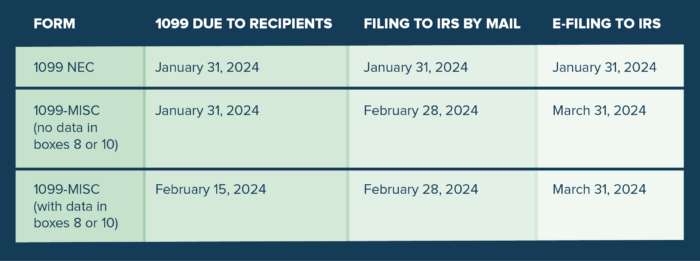

Source : carta.comIRS Form 1099 NEC Due Date 2024 | Tax1099 Blog

Source : www.tax1099.com2024 Tax Deadlines for the Self Employed

Source : found.comWhen & How to file a Form 1099

Source : www.finaloop.com2023 1099, W 2 & ACA Filing Deadlines to the IRS and SSA – CUSTSUPP

Source : support.custsupp.comHow to File 1099 NEC in 2024 — CheckMark Blog

Tax Due Dates For 2024 (Including Estimated Taxes)

Source : thecollegeinvestor.com1099 Deadlines, Penalties & State Filing Requirements 2023/2024

Source : blog.checkmark.com1099 For Property Management: Everything To Know | Buildium

Source : www.buildium.com1099 Deadlines, Penalties & State Filing Requirements 2023/2024

Source : blog.checkmark.comIrs 1099 Filing Deadline 2024 Due Time Business tax deadlines 2024: Corporations and LLCs | Carta: It’s tax time. Here’s a look at what you need to know about due dates for your tax forms, including Forms W-2 and 1099, and what to do if you don’t receive yours on time. . According to the IRS, approximately 90% of tax refunds are issued in under 21 days. However, some tax returns require more attention, which can lengthen the process and push back your tax refund date. .

]]>

.jpg)