1096 Due Date 2024 Taxes Paid

-

admin

- 0

1096 Due Date 2024 Taxes Paid – W hat do I need to know about withholding and estimated taxes?Can I get an extension to pay my taxes?What if I don’t pay enough on time?Is unemployment compensation taxable?Key . 2024. Taxpayers need to file a Form 1040 (or Form 1040-SR, for older adults) and pay any tax due by this date. Tax Day is usually on or around April 15. If April 15 falls on a Saturday .

1096 Due Date 2024 Taxes Paid

Source : www.linkedin.comAbacus Payroll Inc. | Hammonton NJ

Source : www.facebook.comE File Form 1099 NEC Online in 2024! BoomTax

Source : boomtax.com2024 tax calendar Miller Kaplan

Source : www.millerkaplan.comAbacus Payroll Inc. (@AbacusPay) / X

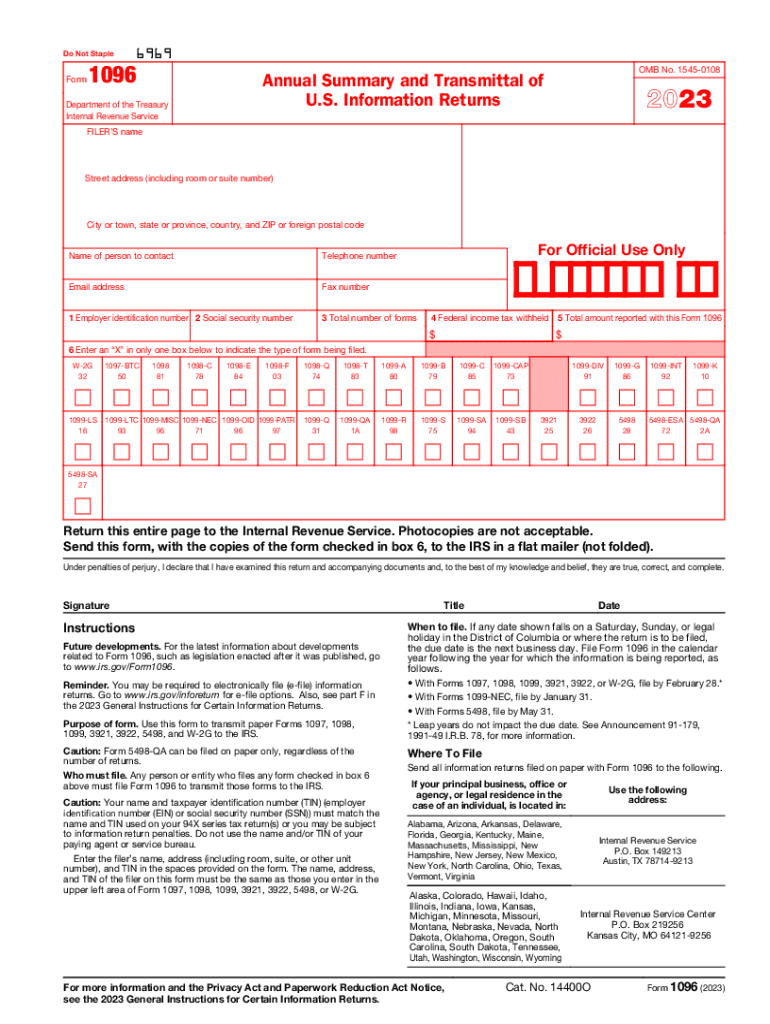

2023 Form IRS 1096 Fill Online, Printable, Fillable, Blank pdfFiller

Source : form-1096.pdffiller.comForm 1096 | Annual Summary and Transmittal of Returns

Source : www.patriotsoftware.comAbacus Payroll Inc. (@AbacusPay) / X

Source : twitter.comChrista Goodrich CPA | Humboldt TN

Source : www.facebook.comAmazon.: Adams 1099 NEC Kit 2023, 3 Up, 5 Part 1099 Forms

Source : www.amazon.com1096 Due Date 2024 Taxes Paid AbacusPayroll: Tax deadlines for employers | Ren Cicalese posted : The IRS announced the tax brackets for the tax year 2024 in November. The agency said in a press release that the top tax rate remains 37% for individual single taxpayers with incomes greater than . Any owed taxes should be paid before the due date to avoid potential penalties and interest on the amount owed. If you request a six-month extension to file taxes, you’ll have until Oct. 15 to .

]]>